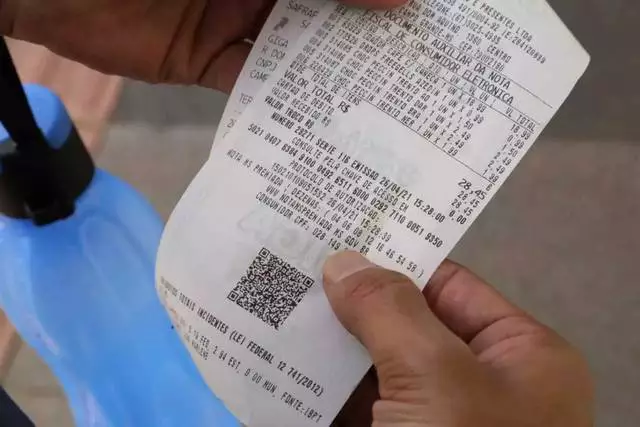

Several purchases we make on a daily basis have some contribution to the Tax on the Circulation of Goods and Services (ICMS), through the CPF in the note. And, in times of crisis, states start to increase the percentages of this cost for the consumer. However, there are some policies that have emerged to return part of the customers' contribution to this tax. This advantage lies in the receipts, which you receive when you purchase a product or service that issues this receipt.

To do this, the consumer must ask the cashier to include the customer's CPF when paying for purchases. Afterwards, the consumer can redeem the amounts they earned with the ICMS refund. Depending on the state, people can even deduct other taxes, or even donate what they received to philanthropic institutions.

Together, the states also seek to offer a technological solution so that people can register and view purchase statements. In general, the federation units, which have a program focused on consumers' CPF, have a website to participate in draws or redeem credits. Below, you can find more details on how to take advantage of offers with the CPF in the note.

CPF in the note: credit consultation and other frequently asked questions

Find out the amounts available for redemption, consult statements with the consumer's CPF and even transfer the accumulated money to your bank account. These are some options that people can choose when accessing services to benefit from the CPF points on the note. Also, several banks have access to transferring consumer resources, both public and private.

If you want, you can even deduct the amount of Motor Vehicle Ownership Tax (IPVA). With the São Paulo Tax Invoice, simply enter the National Motor Vehicle Registry (Renavam) number of the consumer's vehicle. With the Potiguar Note there is the possibility of having a tax discount of up to 10%. But, throughout this article, you will find more information about some types of invoice programs.

If you have debts and have a bad name at Serasa or SPC, don't worry. Fortunately, some programs allow you to participate in the program, depending on conditions in the state in which you live. Regarding registration, the person needs to provide CPF or CNPJ and a password. However, before accessing the program's website or app, make sure you have asked to include your CPF in the note.

How the CPF program works in some states:

Previously, you saw that the advantages are different for each federation unit in Brazil, in relation to the CPF in the note. For example, the ways people can redeem points can be in exchange for tickets to different types of attractions or even cell phone credits. Therefore, it is up to you to pay attention to your state's rules for the benefits program as per the document on the invoice. Therefore, here we will show you just a few examples.

SP: Paulista Invoice

Hundreds of draws are held each month in the São Paulo program, for people who ask for their CPF in the note. By doing this, customers receive a ticket that can give a prize to whoever inserts the document on the tax receipt. In this way, consumers compete for prizes ranging from R$ 1 thousand and R$ 5 thousand, up to one million reais

Also, in SP, there is a transfer fee to be able to transfer the amounts earned with the program. The price is R$ 0.99. Furthermore, consumers in São Paulo can only take advantage of the credits generated in the program one month after each purchase.

Furthermore, registration is done via the State Secretariat of Finance and Planning, where people enter a password and their CPF. If you own a company, for example, you can enter your CNPJ. Therefore, once the user is in the system, they can check a list of the history of invoices for purchases they have made. Thus, people can access the points, with the option “Use credits” or “Make transfer“, if you want to transfer the amounts to your account.

PR: Nota Paraná (Paraná Pay)

In Paraná, the transfer of the amounts that people earn with the CPF program into the note depends on the accumulation of 25 reais. When the value is reached, the user can withdraw and deduct 3% from the IPVA, if they want to pay the tax in just one installment.

In addition, registration on the program website is done using a form. Then, the user has to create an access password, providing the CPF, their name and that of their mother, date of birth and zip code.

In contrast, credit is calculated three months after purchase. Subsequently, the information so that the value is paid, they arrive at the finance department and the person receives the program amounts.

Furthermore, the state of Paraná offers an extra option to use the credits. O Paraná Pay allows people to use the accumulated amounts to pay for transport expenses, events and tourist attractions in the state, among other options.

CE: Your Grade Has Value

In Ceará, the Sua Nota Tem Valor program also benefits consumers with raffles, prizes and a 5% discount on the IPVA value. Therefore, a higher percentage than in the states mentioned before. And the minimum required to obtain a point in the program is R$ 25 consumption, but there is a limit. People can accumulate a maximum of 100 points per month.

Registration follows the same operation as Nota Paraná. Regarding the draws, the Ceará points program drew, in January 2022, R$ 100 thousand. To get an idea of how the reward has a certain duration, participants could only compete if they had issued a note with a CPF in December of the previous year.

Furthermore, both the website Your Note Has Value like the app are available to check the points and also to find out if the consumer was selected in the prizes held by the Ceará Finance Department.